Premium Bonds Bond Value Meaning

Youve got to sit down Im going to tell you something. The call premium is paid to investors as compensation for the lost future income on the bond investment.

Bond Discount Or Premium Amortization Soleadea

Premium Bond prizes are tax-free but so is savings interest for 95 of people.

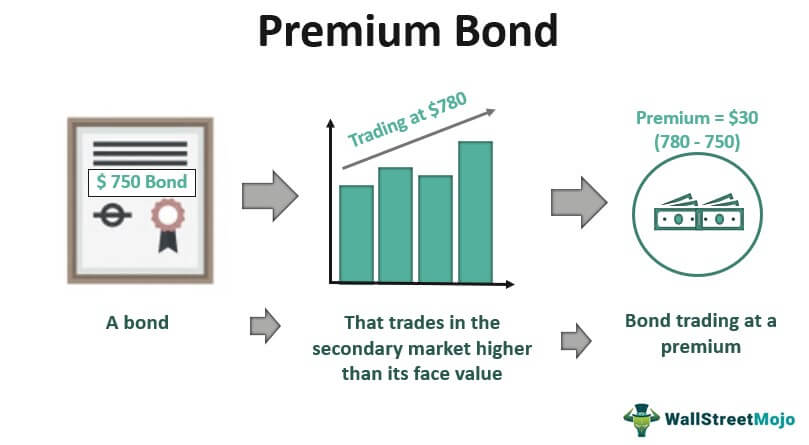

Premium bonds bond value meaning. Premium bond a FINANCIAL SECURITY issued by the UK government as a means of raising money for the government and encouraging private SAVINGPremium bonds are issued in small denominations but do not pay interest nor can a capital gain be obtained on redemption since they are issued and redeemed at their face value. If a bond is trading at a premium this simply means it is selling for more than its face value. This is because investors want a.

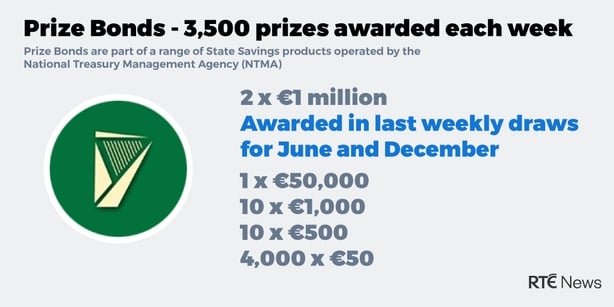

What is a bond discount. It is estimated that the chance of a single Premium Bond winning a monthly prize is 34500 to 1 and for a 1000 prize the odds jump to over 544 million to 1. You will learn how to value a bond with a step-by-step example.

I have diligently informed ERNIE of my change of address and checked the numbers on line I still have the original bonds. Bond investments should be evaluated in the context of expected future short and long-term interest. For example if you wish to purchase a bond maturing in 8 years with a specific.

Alexa have I won. Very old Premium Bonds. This is the attraction to premium bond pricing and rates.

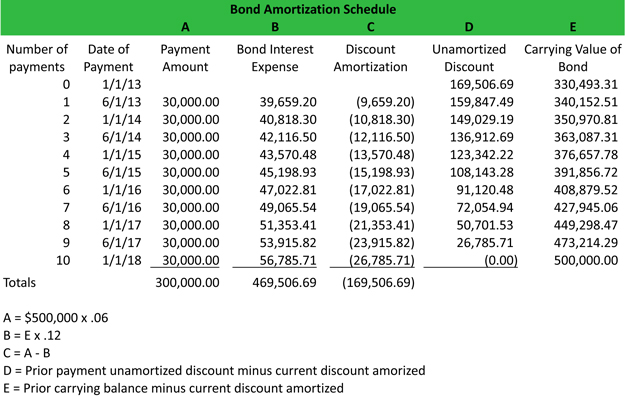

This is a discounted bond meaning an investor would pay less for the same yield making it a better option. Amortizing bonds discount using the straight-line method. For retired or soon-to-be-retired clients a 5year short term bond ladder adds.

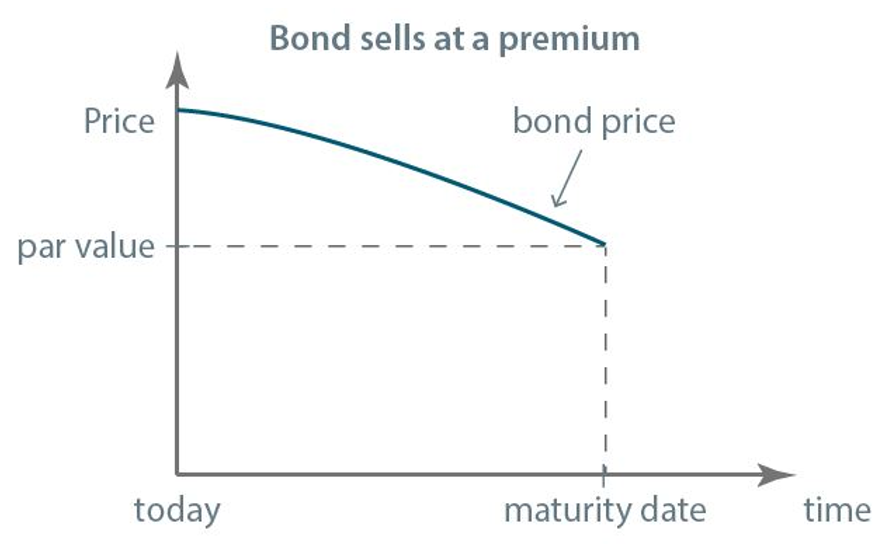

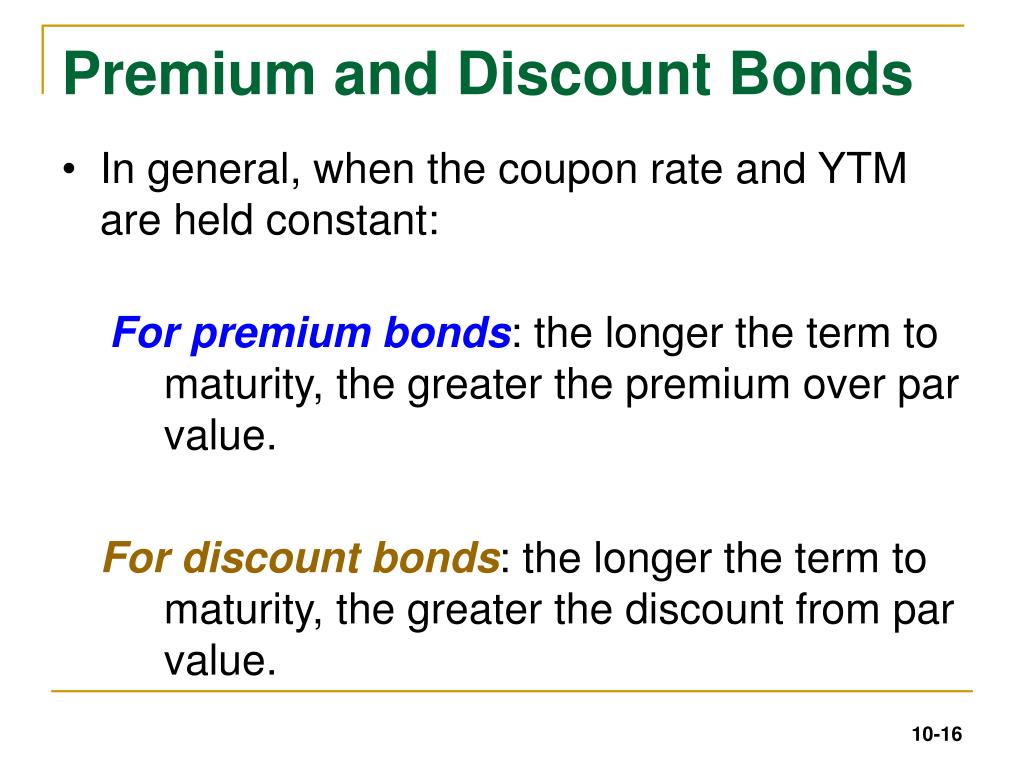

What is a bond premium. The price you pay for a bond may be different from its face value and will change over the life of the bond depending on factors like the bonds time to maturity and the interest rate environment. A person would buy a bond at a premium pay more than its maturity value because the bonds stated interest rate and therefore its interest payments are greater than those expected by the current bond market.

An aunt then sent me another one yes one in the same year. It is also possible that a bond investor will have no choice. Investors often wonder about the new issue price of bonds if their interest rate changes or if they are trading at a premium.

Most bonds are issued in 1000 denominations so typically the face value of a bond will be just that 1000. Why would someone buy a bond at a premium. The day James became a millionaire and nearly didnt find out.

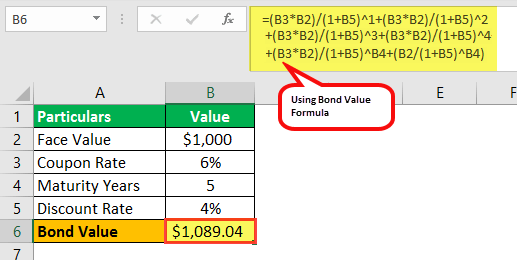

In 1963 I purchased 2 yes two 1 Premium Bonds with my summer hols working pay. To find the bond value or issue price we need to add the present value of the bond and the present value of interest. Previously the prize rate for Premium Bonds was 14 percent this means each 1 bond had a one in 24500 chance of winning a prize.

At present it is issued by the governments National Savings and Investments agency. Those who are lucky. Check prizes for the whole family using just your voice.

For stock options a call premium is what an investor pays for buying a call option. This video illustrates the following. Bond valuation is a means of determining a bonds fair value based on its worth at maturity and the annual interest rate or coupon payment.

There is a lot packed into that definition so breaking it down can provide clarity. A premium bond is a bond trading above its par value. The change meant the prize rate was slashed to.

The call premium is the amount above par value an investor receives when the debt issuer redeems the security earlier than its maturity date. I AM holding premium bonds which belonged to my son who is now deceasedThe bond was bought in Carmarthen on Febuary 7th 1975 and is valued at 2. Our bond traders are accustomed to dealing with premium and discount bonds as well as the different calculations needed when purchasing bonds on the secondary market.

However the more Premium Bonds you own the greater your. The principle behind Premium Bonds is that rather than the stake being gambled as in a usual lottery it is the interest on the bonds that is distributed by a lotteryThe bonds are entered in a monthly prize draw and the. Yet if youre one of those who earns more interest than your personal savings allowance then if youve a decent amount in bonds theyll usually be the clear winner especially as cash ISA rates are poor.

Still premium bonds with higher pricing and a lower rate might earn more if the market rate is lower than the bond rate. You might also see bonds with face values of 100 5000 and 10000. Has it any value.

Issue price or the bond price can also be understood as the bond value. Premium Bond Value Formula. This means that the majority of Premium Bonds will not collect even the smallest prize of 25 in their owners lifetime.

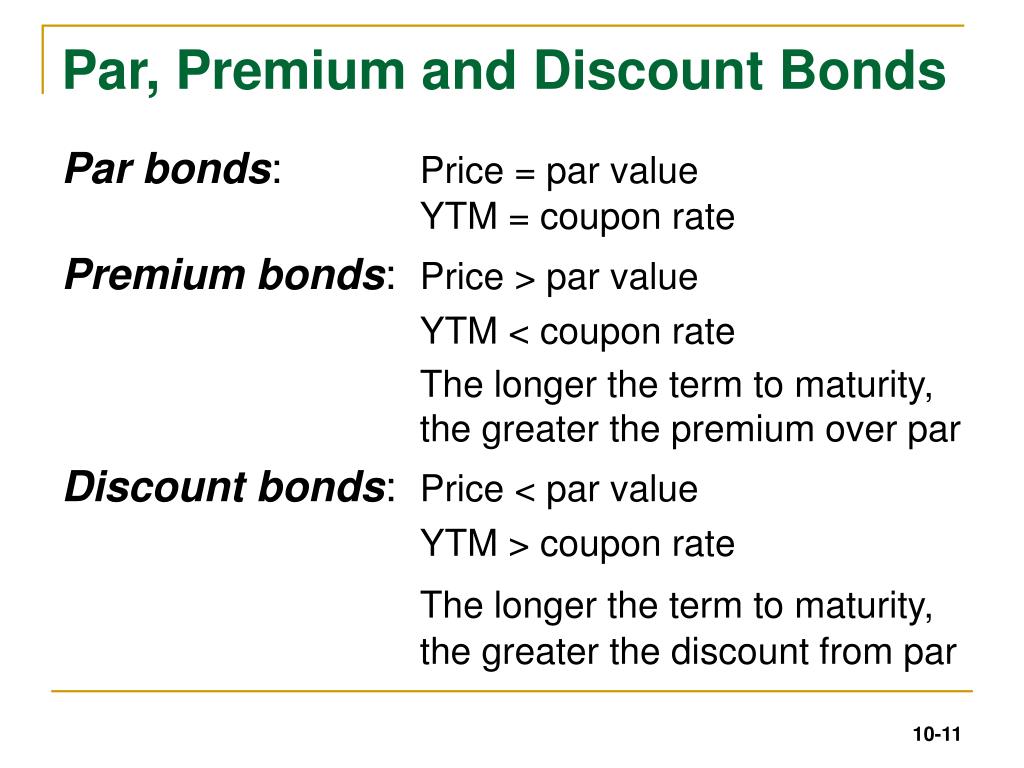

A Premium Bond is a lottery bond issued by the United Kingdom government since 1956. A bond trades at a premium when it offers a coupon rate higher than prevailing interest rates. When bond interest rates increase prices go down.

Not won a thing. If you are referring to the high value premium bond winners table on the NSI website the Holding is the total amount of premium bonds held and the Bond Value is the block of premium bonds.

Understanding Bond Prices And Yields

Volatility Of Bond Prices In The Secondary Market

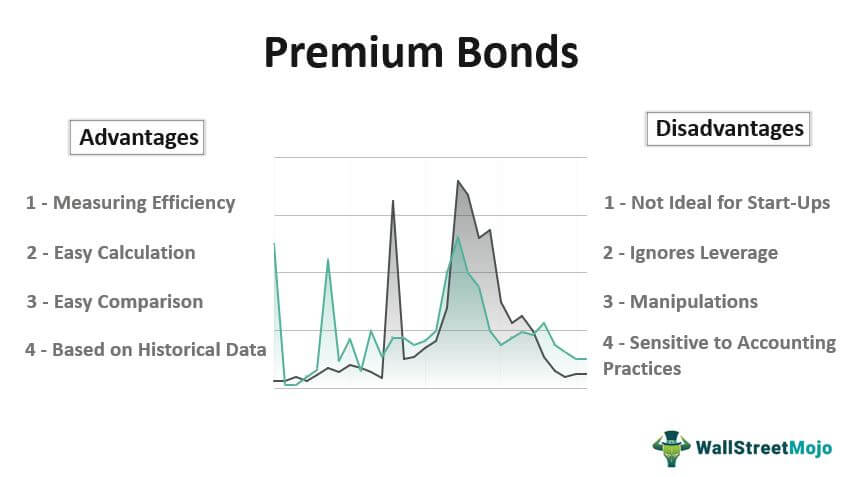

Premium Bonds Definition Overview Valuation Calculations

What Is A Carrying Value Of A Bond Definition Meaning Example

Premium Bonds Definition Overview Valuation Calculations

Discount Bond Definition Examples Top 2 Types Of Discount Bonds

/dotdash_Final_Bond_Apr_2020-01-63d1901859ed40f5bc7533de1a31e857.jpg)

Bond Definition Understanding What A Bond Is

Ppt Chapter 10 Powerpoint Presentation Free Download Id 1138614

Premium Bonds Definition Overview Valuation Calculations

What Are Prize Bonds And Should I Be Buying Them

Bond Yields Nominal And Current Yield Yield To Maturity Ytm With Formulas And Examples

The Premium Bond Conundrum Osborne Partners Capital Management Llc

Ppt Chapter 10 Powerpoint Presentation Free Download Id 1138614

:max_bytes(150000):strip_icc()/ConvertibleBondsPrice2-2285ff1211c545be919565380a232a02.png)

An Introduction To Convertible Bonds

Ppt Chapter 10 Powerpoint Presentation Free Download Id 1138614

2021 Cfa Level I Exam Cfa Study Preparation

Issuing Bonds At A Discount Or A Premium Video Lesson Transcript Study Com